Acorns - Turn small investments into big gains

Overview:

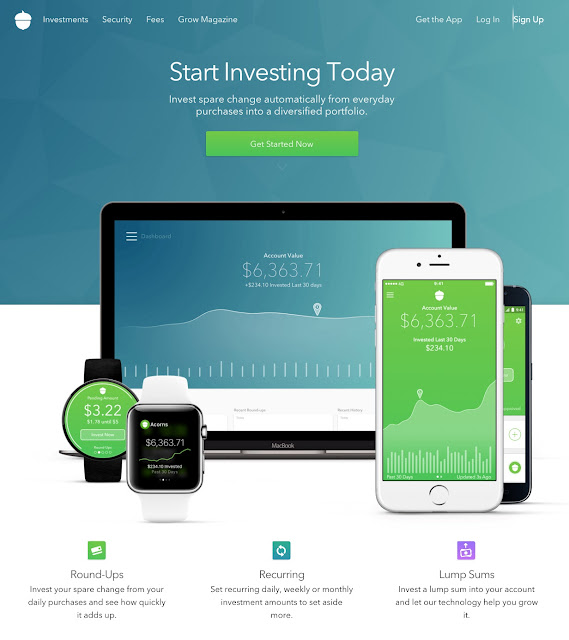

Acorns is an app that allows you to invest your "spare change" automatically and is revolutionizing the way you could be saving for your retirement or any other purpose. I have personally started saving with this app about a year ago and find it very helpful because I have been able to save money little at a time that I would not have saved otherwise and would have spent it on non-essential purchases. Here is a snapshot of acorns and the way it looks on various devices. I have used the app on my iPhone and love it and I have logged in on my desktop computer, however I have not personally interacted with it using the iWatch.

Types of investments:

I have set up several of my accounts for the round-ups and essentially it works the way you would think, every time I use the card associated with the linked account, it invests the spare change by rounding it up to the nearest dollar, however you have to reach at least 5 dollars for this to happen. The only thing that surprised me about this (though it perhaps shouldn't have) is that round-up amounts from credit card purchases get drawn out of your checking account, so just be prepared for that. I have also set up a recurring weekly payment which is adding up and is the easiest way I have every saved money. I have not had large sums of money to invest, but investing lump some money is equally easy (especially when the money is drawn from an already linked account). The only other thing that you will want to keep in mind is that if you withdraw money from this account - it will automatically cause it to generate a 1099 tax form, so perhaps you want to only use this type of investing for longer term horizons rather than pulling out money frequently.

Fees:

Acorns is free for students who sign up with a .edu email address and is relatively cheap for all others at either $1 a month or 0.25% once the account value reaches over $5,000 in value. What is really nice is that depositing money or drawing money out of the account is free and unlimited.

Investment portfolio and dividends:

When you set up your Acorns account, you get to choose how aggressive you want your portfolio to be and making changes to the settings is very easy. You have to keep in mind however that your amounts will change with the stock market's performance as your money is invested and thus it is possible to lose money as it is also possible for your money to grow. One cool benefit of investing your money this way is that even if you only own percentages of stocks, you will get paid out dividends from those that pay them, which is an additional boost to your total balance. I personally find these deposits quite thrilling :-)

Make your first investment today:

If you are ready to get started and want to earn $5 in starter credit, download your acorns app now!

Security:

I imagine, right about now, you are thinking that this is too good to be true and you might be worried about the security of the app. Well, I want you to relax because your investments will be safe and I believe that the fact that the app has won several awards such as the Best Design Award of 2014 and Best Mobile App Award in 2015 only support the notion that this app is ready for prime time and you can safely use it to save your spare change and watch it grow!

I sincerely hope you will find Acorns as helpful to getting to your future savings goal as I do. Drop me a note if you would like any more information or just to let me know how much you love saving with Acorns.

Date posted: 3/5/2016

Author: Anna McNab, Ph.D.

Acorns is an app that allows you to invest your "spare change" automatically and is revolutionizing the way you could be saving for your retirement or any other purpose. I have personally started saving with this app about a year ago and find it very helpful because I have been able to save money little at a time that I would not have saved otherwise and would have spent it on non-essential purchases. Here is a snapshot of acorns and the way it looks on various devices. I have used the app on my iPhone and love it and I have logged in on my desktop computer, however I have not personally interacted with it using the iWatch.

|

| Acorns overview |

I have set up several of my accounts for the round-ups and essentially it works the way you would think, every time I use the card associated with the linked account, it invests the spare change by rounding it up to the nearest dollar, however you have to reach at least 5 dollars for this to happen. The only thing that surprised me about this (though it perhaps shouldn't have) is that round-up amounts from credit card purchases get drawn out of your checking account, so just be prepared for that. I have also set up a recurring weekly payment which is adding up and is the easiest way I have every saved money. I have not had large sums of money to invest, but investing lump some money is equally easy (especially when the money is drawn from an already linked account). The only other thing that you will want to keep in mind is that if you withdraw money from this account - it will automatically cause it to generate a 1099 tax form, so perhaps you want to only use this type of investing for longer term horizons rather than pulling out money frequently.

Fees:

Acorns is free for students who sign up with a .edu email address and is relatively cheap for all others at either $1 a month or 0.25% once the account value reaches over $5,000 in value. What is really nice is that depositing money or drawing money out of the account is free and unlimited.

|

| Acorns fees |

When you set up your Acorns account, you get to choose how aggressive you want your portfolio to be and making changes to the settings is very easy. You have to keep in mind however that your amounts will change with the stock market's performance as your money is invested and thus it is possible to lose money as it is also possible for your money to grow. One cool benefit of investing your money this way is that even if you only own percentages of stocks, you will get paid out dividends from those that pay them, which is an additional boost to your total balance. I personally find these deposits quite thrilling :-)

Make your first investment today:

If you are ready to get started and want to earn $5 in starter credit, download your acorns app now!

Security:

I imagine, right about now, you are thinking that this is too good to be true and you might be worried about the security of the app. Well, I want you to relax because your investments will be safe and I believe that the fact that the app has won several awards such as the Best Design Award of 2014 and Best Mobile App Award in 2015 only support the notion that this app is ready for prime time and you can safely use it to save your spare change and watch it grow!

|

| Acorns security promise |

Date posted: 3/5/2016

Author: Anna McNab, Ph.D.

Comments

Post a Comment